Advanced Bookkeeping Techniques for Professionals 8329821428

Advancements in bookkeeping techniques are essential for professionals aiming to improve efficiency and accuracy. Automation has emerged as a key strategy, minimizing manual errors and speeding up payment cycles. In addition, cloud-based accounting software offers real-time data access, enhancing decision-making and security. Regular reconciliations build trust in financial reporting, while financial analytics facilitate strategic planning. These methods collectively reshape financial management, but the implications of their integration warrant further exploration.

Implementing Automation in Bookkeeping Processes

As businesses increasingly seek efficiency in their operations, implementing automation in bookkeeping processes emerges as a strategic necessity.

Automated invoicing stands out as a key component, significantly reducing manual entry errors and expediting payment cycles.

Coupled with workflow optimization, these automation tools enhance overall productivity, allowing financial professionals to focus on strategic decision-making rather than repetitive tasks, thereby fostering greater organizational freedom.

Utilizing Cloud-Based Accounting Software

The integration of automation in bookkeeping has paved the way for the adoption of cloud-based accounting software, which offers significant advantages in managing financial data.

Through cloud integration, businesses can access real-time information, enhancing decision-making capabilities.

Additionally, robust data security measures protect sensitive financial information, ensuring compliance and safeguarding against breaches.

This modern approach empowers professionals, offering them flexibility and control over their bookkeeping processes.

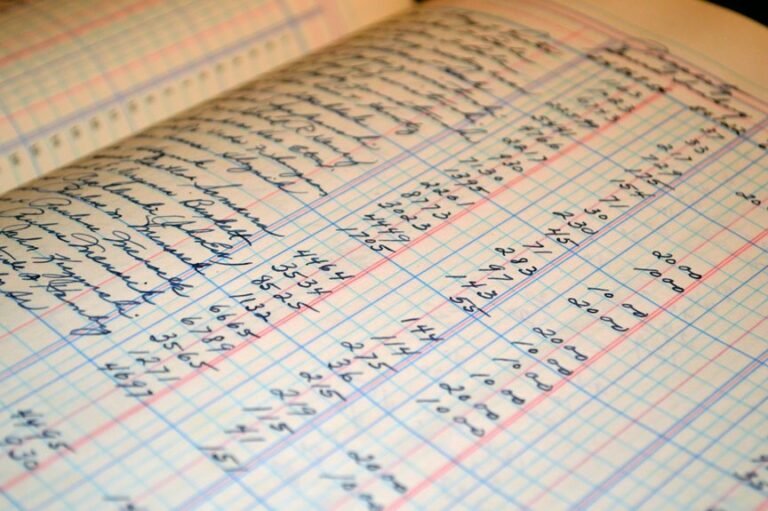

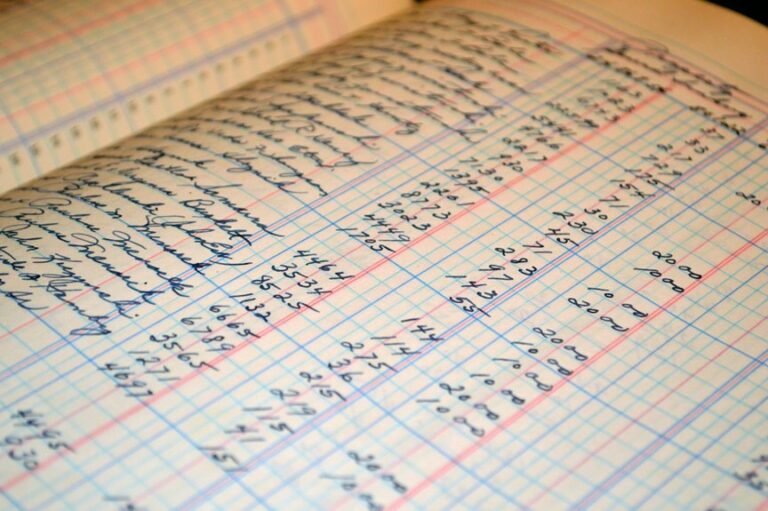

Enhancing Accuracy With Regular Reconciliations

While maintaining financial accuracy can be challenging, regular reconciliations serve as a critical tool for ensuring that discrepancies are identified and resolved promptly.

Employing reconciliation best practices, professionals can discern the merits of manual versus automated processes, optimizing their approach to accuracy.

Regular checks not only enhance trust in financial statements but also empower stakeholders with the freedom to make informed decisions.

Leveraging Financial Analytics for Strategic Decision-Making

Regular reconciliations lay a solid foundation for leveraging financial analytics, enabling organizations to make informed strategic decisions.

Through effective financial forecasting and cost analysis, professionals can identify trends, optimize resource allocation, and enhance profitability.

This analytical approach empowers decision-makers to navigate uncertainties and seize opportunities, ultimately fostering a dynamic environment conducive to growth and innovation within their organizations.

Conclusion

In conclusion, advanced bookkeeping techniques significantly enhance financial management for professionals through automation, cloud-based solutions, regular reconciliations, and financial analytics. For instance, a mid-sized manufacturing firm that adopted automated invoicing and cloud accounting saw a 30% reduction in payment cycle times and a 40% decrease in manual errors, leading to improved cash flow and strategic resource allocation. Such practices not only foster operational efficiency but also empower organizations to focus on growth and innovation in their financial endeavors.