Building a Financial Framework With Bookkeeping 4694479430

Building a financial framework with bookkeeping is a critical aspect of effective financial management. It involves systematic recording and analysis of transactions, which can significantly enhance a business’s understanding of its financial status. By adopting advanced tools and best practices, organizations can transform raw data into actionable insights. This approach not only facilitates cash flow management but also opens avenues for identifying growth opportunities. What remains to be explored is how these elements intertwine to impact strategic decisions.

Understanding the Basics of Bookkeeping

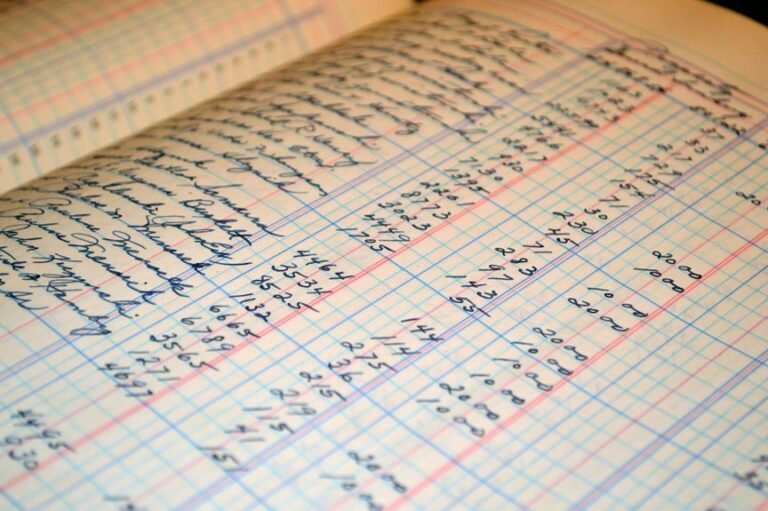

Bookkeeping serves as the foundational element of financial management, encapsulating the systematic recording of financial transactions.

Understanding bookkeeping terminology is crucial for interpreting financial statements accurately. Key concepts such as debits, credits, and ledgers form the bedrock of effective financial oversight.

Essential Bookkeeping Tools and Software

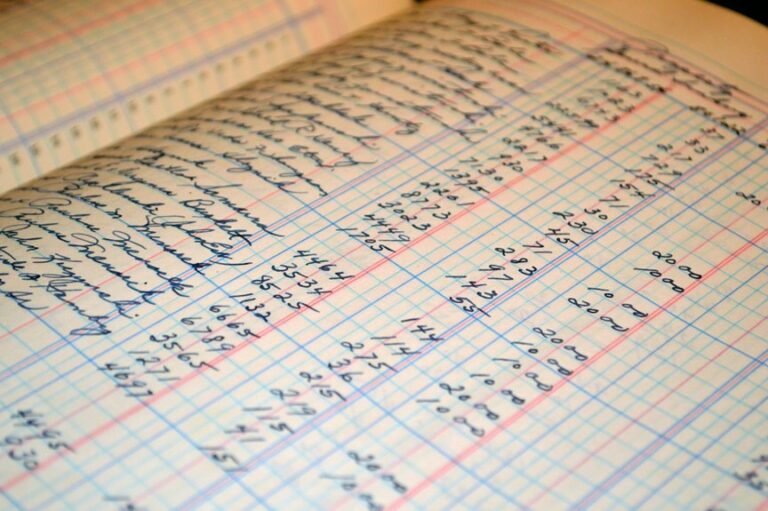

Choosing the right tools and software for bookkeeping is essential for maintaining accurate financial records and streamlining administrative tasks.

Cloud solutions provide accessibility and scalability, facilitating collaboration across locations. Meanwhile, mobile apps enhance convenience, allowing users to manage finances on-the-go.

Utilizing these technologies empowers individuals to efficiently track their financial health, ultimately offering the freedom to focus on growth and strategic decision-making.

Best Practices for Maintaining Accurate Financial Records

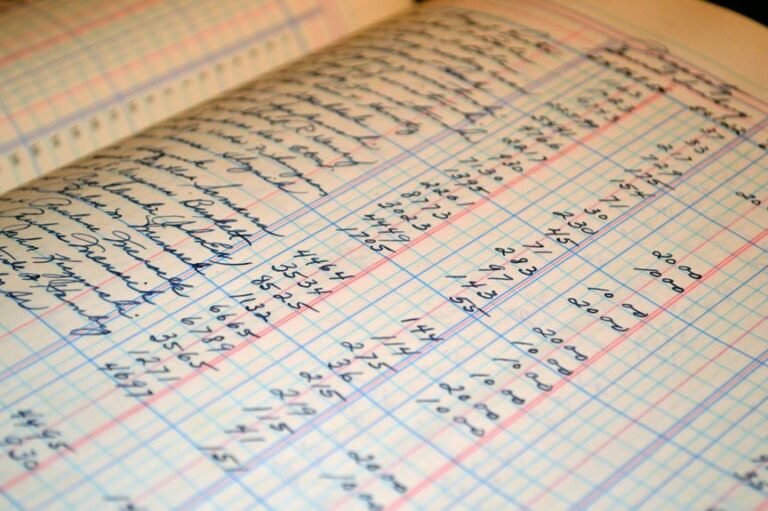

Effective utilization of advanced bookkeeping tools and software lays the foundation for maintaining accurate financial records.

Key best practices include diligent record organization and regular financial reconciliation.

Establishing a systematic approach ensures that all transactions are documented correctly, minimizing discrepancies.

Leveraging Bookkeeping for Strategic Financial Decision-Making

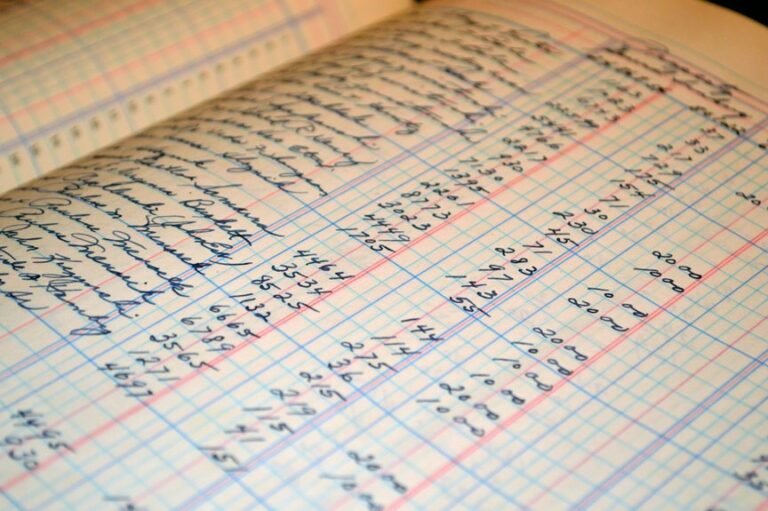

Strategic financial decision-making hinges on the insights derived from meticulous bookkeeping practices.

By conducting thorough financial analysis, businesses can assess their cash flow effectively, identifying trends and anomalies. This data-driven approach empowers decision-makers to allocate resources wisely, minimize risks, and seize growth opportunities.

Ultimately, leveraging bookkeeping not only enhances financial clarity but also fosters a sense of freedom in navigating complex financial landscapes.

Conclusion

In the intricate tapestry of business finance, bookkeeping stands as the sturdy thread that weaves together clarity and insight. By embracing essential tools and adhering to best practices, companies can construct a robust financial framework, akin to a lighthouse guiding ships through turbulent waters. This vigilant oversight not only illuminates the path to informed decision-making but also unveils hidden opportunities for growth, allowing businesses to navigate the complexities of the financial landscape with unwavering confidence.