Building a Strong Financial Foundation With Bookkeeping 5036626023

Bookkeeping is a critical component of effective financial management for businesses. It establishes a framework for accurate record-keeping and expense tracking. These practices enable informed decision-making and resource allocation. Furthermore, engaging professional bookkeeping services can significantly reduce errors and improve operational efficiency. Understanding these aspects is essential for any business aiming for stability and growth. However, the implications of neglecting proper bookkeeping may reveal unforeseen challenges ahead.

The Role of Bookkeeping in Financial Management

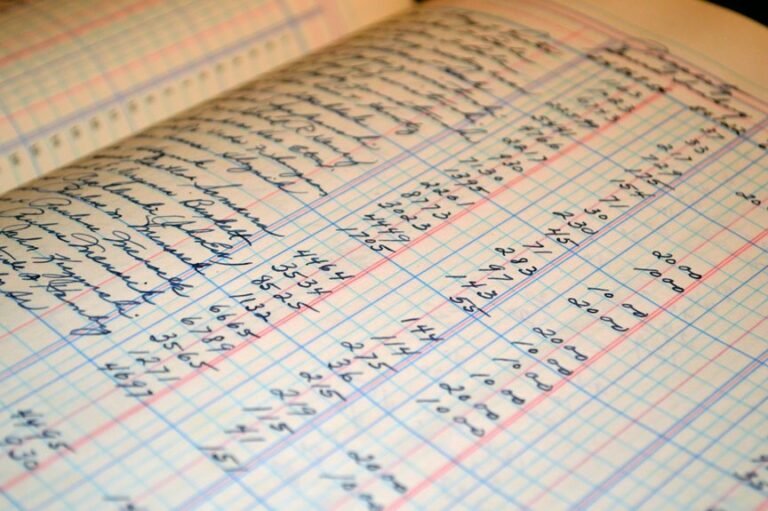

Bookkeeping serves as the backbone of effective financial management, providing the essential framework for tracking and analyzing a business’s financial transactions.

Through meticulous expense tracking, businesses achieve financial accuracy, ensuring that resources are allocated efficiently.

This foundational practice not only supports compliance with regulations but also empowers informed decision-making, ultimately fostering a climate of financial freedom and stability for business owners.

Key Bookkeeping Practices for Success

Successful bookkeeping practices are essential for any business aiming to achieve financial stability and growth.

Maintaining accurate records fosters informed decision-making, while diligent expense tracking allows for effective budget management.

Implementing consistent reconciliation processes and utilizing technology can streamline operations.

Benefits of Professional Bookkeeping Services

Many businesses find that engaging professional bookkeeping services significantly enhances their financial management.

These services provide cost savings by minimizing errors and optimizing resource allocation. Additionally, they enhance time efficiency, allowing business owners to focus on core operations rather than administrative tasks.

Ultimately, professional bookkeeping fosters a more organized financial structure, enabling businesses to make informed decisions and pursue growth opportunities more effectively.

Staying Compliant and Prepared for Growth

While navigating the complexities of financial regulations, businesses must prioritize compliance to avoid penalties and ensure sustainable growth.

Implementing effective compliance strategies is essential for maintaining order and preparing for expansion. By integrating compliance into growth planning, organizations can create a robust foundation that supports both regulatory adherence and strategic objectives.

Ultimately, this approach empowers them to capitalize on opportunities while mitigating risks associated with non-compliance.

Conclusion

In conclusion, while some may argue that bookkeeping is a mundane task that can be managed in-house, the reality is that professional bookkeeping services provide invaluable expertise that enhances financial accuracy and strategic planning. By ensuring meticulous record-keeping and compliance, businesses can focus on growth and innovation rather than drowning in paperwork. Investing in professional bookkeeping not only streamlines operations but also positions organizations to navigate financial complexities with confidence, ultimately laying the groundwork for sustained success.