Effective Budgeting and Bookkeeping Techniques in Bookkeeping 4252302520

Effective budgeting and bookkeeping techniques play a pivotal role in the financial sustainability of organizations. By adopting a zero-based budgeting approach and integrating advanced technology, businesses can streamline their financial processes significantly. This ensures resource allocation is tightly aligned with strategic objectives. However, the true challenge lies in maintaining accuracy and accountability throughout these practices. Understanding how to navigate these complexities can lead to more informed decision-making and enhanced financial performance. What strategies can further optimize this process?

Understanding the Fundamentals of Budgeting

A comprehensive understanding of budgeting is essential for effective financial management.

Various budget types, such as zero-based and incremental, cater to different financial needs.

Implementing robust expense tracking methods allows individuals to monitor spending patterns and make informed decisions.

This analytical approach empowers individuals to allocate resources efficiently, ultimately fostering financial independence and freedom, while promoting accountability and strategic financial planning.

Streamlining Bookkeeping Processes With Technology

Effective budgeting lays the groundwork for sound financial management, but the integration of technology into bookkeeping processes can significantly enhance efficiency and accuracy.

Cloud solutions facilitate remote access to financial data, promoting collaboration and flexibility.

Additionally, automation tools streamline repetitive tasks, reducing manual errors and saving time.

This technological advancement empowers businesses to focus on strategic decision-making, ultimately fostering financial freedom and growth.

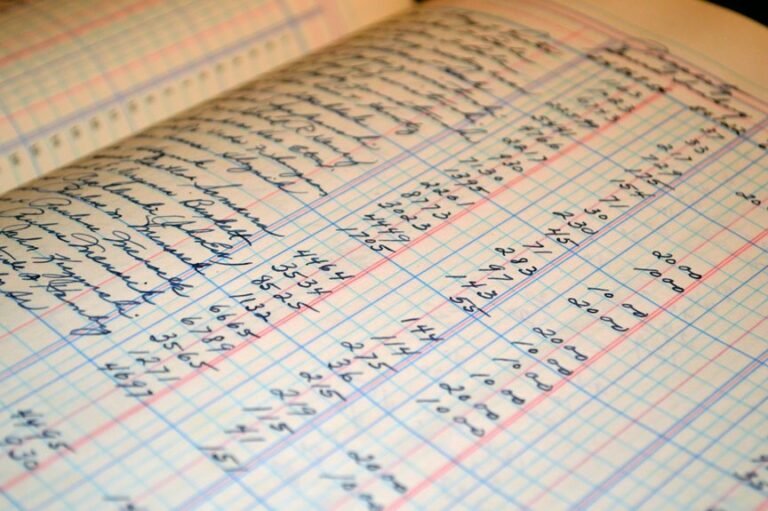

Best Practices for Accurate Financial Reporting

While financial reporting is crucial for assessing a company’s performance, adhering to best practices ensures that the information presented is both accurate and reliable.

To achieve financial accuracy, organizations should comply with established reporting standards, maintain consistent documentation, and conduct regular audits.

These practices not only foster transparency but also enhance stakeholder trust, ultimately supporting informed decision-making within the business environment.

Analyzing Financial Performance for Strategic Decision Making

Accurate financial reporting serves as a foundation for analyzing financial performance, which is vital for strategic decision-making.

By utilizing financial ratios and performance metrics, organizations can assess profitability, efficiency, and liquidity.

These analytical tools provide insights that empower stakeholders to make informed choices, ultimately fostering a culture of accountability and freedom in financial management.

This ensures resources are allocated effectively for sustainable growth.

Conclusion

In the intricate tapestry of financial management, effective budgeting and bookkeeping serve as the threads that weave together a company’s fiscal health. By embracing zero-based budgeting and leveraging advanced technology, organizations can transform their financial landscapes into vibrant mosaics of efficiency and clarity. Just as a skilled artisan meticulously crafts each detail, these practices empower stakeholders to navigate the complexities of financial performance, ensuring that every decision is both informed and strategically aligned for sustainable growth.