Essentials for Small Businesses in Bookkeeping 18332147629

Bookkeeping serves as the backbone of small business financial management. It involves systematic tracking of income and expenses, which is vital for understanding profitability. Additionally, managing payroll and tax obligations can prevent costly errors. Effective bookkeeping software further enhances these processes. However, many business owners overlook key aspects that could significantly impact their financial stability. Understanding these essentials is crucial for long-term success in an increasingly competitive landscape.

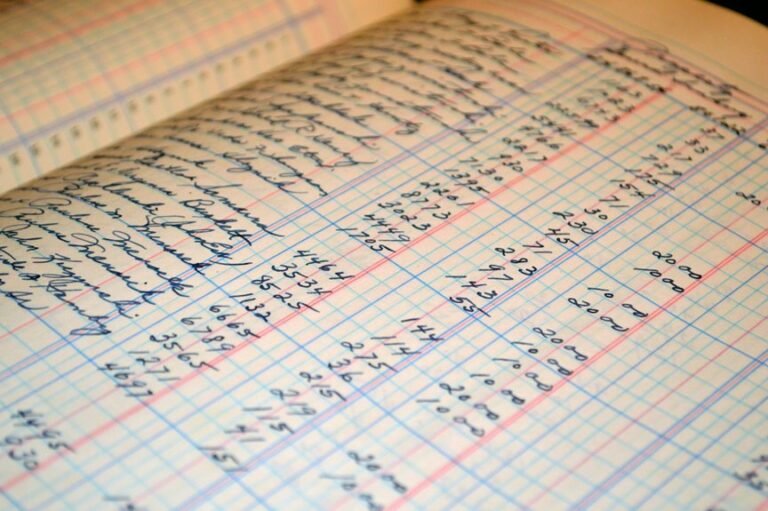

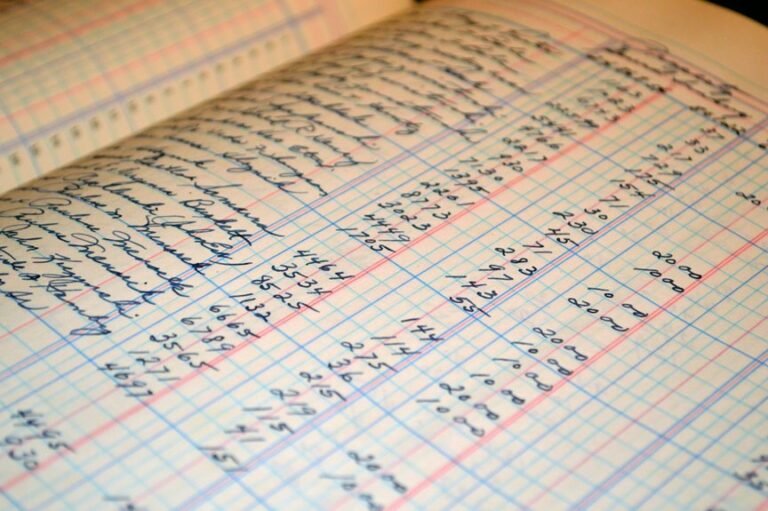

Understanding the Basics of Bookkeeping

Bookkeeping serves as the backbone of any small business, providing an organized framework for financial management.

Understanding bookkeeping terminology is essential for interpreting financial statements accurately. This knowledge allows business owners to make informed decisions, enhancing their financial freedom.

Tracking Income and Expenses Efficiently

While many small business owners recognize the importance of tracking income and expenses, few understand the best practices that can streamline this process.

Implementing effective income tracking methods, such as utilizing accounting software, enhances accuracy.

Additionally, applying expense categorization tips ensures that financial data is organized systematically, providing clearer insights into profitability and operational efficiency.

Ultimately, this facilitates informed decision-making for business growth.

Managing Payroll and Tax Obligations

Effective management of payroll and tax obligations is crucial for maintaining the financial health of a small business.

Accurate payroll calculations ensure employees are compensated correctly, fostering morale and productivity.

Additionally, adhering to tax deadlines mitigates the risk of penalties, allowing business owners to allocate resources effectively.

A systematic approach to these responsibilities empowers small businesses to thrive in a competitive marketplace.

Implementing Effective Bookkeeping Software

The integration of robust bookkeeping software can significantly enhance the efficiency and accuracy of financial management in small businesses.

Careful software selection is crucial; it should align with specific business needs and scalability.

Additionally, comprehensive user training ensures that employees can effectively utilize the software, minimizing errors and maximizing productivity.

Emphasizing these elements fosters a streamlined financial process, promoting overall business growth and autonomy.

Conclusion

In conclusion, mastering bookkeeping is vital for small businesses seeking financial clarity and operational success. By understanding the basics, tracking income and expenses diligently, managing payroll and tax obligations effectively, and implementing tailored bookkeeping software, entrepreneurs position themselves for sustainable growth. Organized financial data not only enhances decision-making but also fosters a foundation of financial autonomy. Ultimately, a robust bookkeeping system transforms challenges into opportunities, enabling small businesses to thrive in an increasingly competitive landscape.