Financial Accuracy in Bookkeeping 18449270314

Financial accuracy in bookkeeping serves as the backbone of organizational integrity. It ensures compliance with regulatory standards and builds trust among stakeholders. Furthermore, precise record-keeping influences critical decision-making and risk management. Yet, many organizations overlook best practices, leading to costly pitfalls. Understanding the implications of accurate bookkeeping can reveal insights into a company’s financial health and overall success. What are the key strategies that can fortify this essential function?

The Importance of Financial Accuracy in Bookkeeping

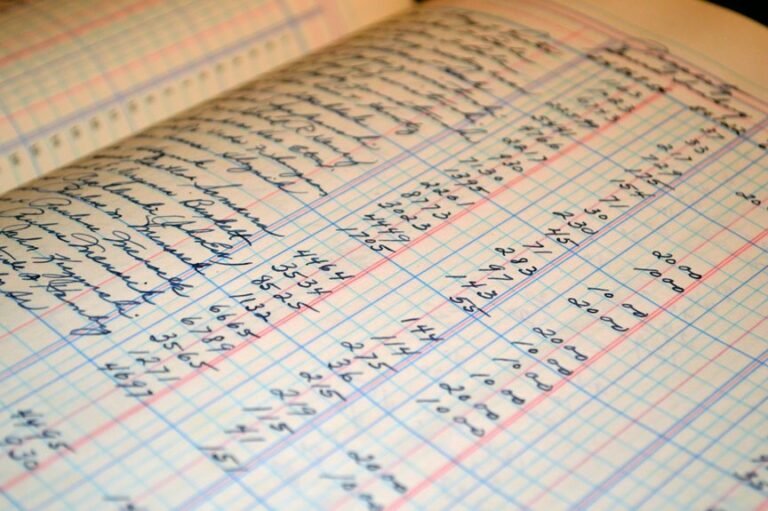

Although financial accuracy in bookkeeping may seem like a basic requirement, its significance extends far beyond mere compliance with regulations.

Ensuring financial integrity through meticulous data validation fosters trust among stakeholders and supports informed decision-making. This accuracy not only mitigates risks but also empowers organizations to navigate financial landscapes with confidence, ultimately promoting a culture of transparency and accountability essential for true autonomy.

Best Practices for Maintaining Accurate Financial Records

To maintain accurate financial records, organizations must implement systematic practices that ensure data integrity and consistency.

Utilizing digital tools facilitates efficient data entry and retrieval, while robust record organization enhances clarity and reduces errors.

Regular audits and reconciliations further strengthen accuracy, enabling organizations to uphold financial transparency.

Common Pitfalls to Avoid in Bookkeeping

Identifying common pitfalls in bookkeeping is crucial for maintaining financial accuracy and integrity.

Many professionals encounter issues such as improper data entry, leading to discrepancies in financial records.

Additionally, reconciliation errors can arise when comparing bank statements with internal accounts.

Recognizing these challenges enables individuals to implement corrective measures, safeguarding their financial practices and enhancing overall operational efficiency.

The Impact of Accurate Bookkeeping on Business Success

Accurate bookkeeping serves as the backbone of business success, providing a clear financial picture essential for informed decision-making.

It enhances financial forecasting capabilities, enabling companies to anticipate market trends and adjust strategies accordingly.

Furthermore, meticulous revenue tracking allows businesses to identify growth opportunities and manage expenditures effectively.

Ultimately, precision in bookkeeping empowers organizations to pursue their objectives with confidence and autonomy.

Conclusion

In conclusion, financial accuracy in bookkeeping is paramount for organizational integrity and success. As the adage goes, “A stitch in time saves nine,” highlighting the importance of proactive measures in maintaining precise records. By adhering to best practices and avoiding common pitfalls, businesses can not only ensure compliance but also foster stakeholder trust. Ultimately, accurate bookkeeping serves as a foundation for informed decision-making, effective resource management, and strategic adaptability in an ever-evolving market landscape.