Financial Mastery With Bookkeeping 18664695427

Financial mastery through bookkeeping is a critical skill for both individuals and businesses. It involves a systematic approach to tracking financial transactions, which can lead to improved decision-making and financial health. Understanding the foundational concepts of assets, liabilities, and equity is essential. However, effective financial management requires more than just knowledge. The integration of modern tools and best practices can transform how one engages with their finances. What are the most effective strategies for leveraging these resources?

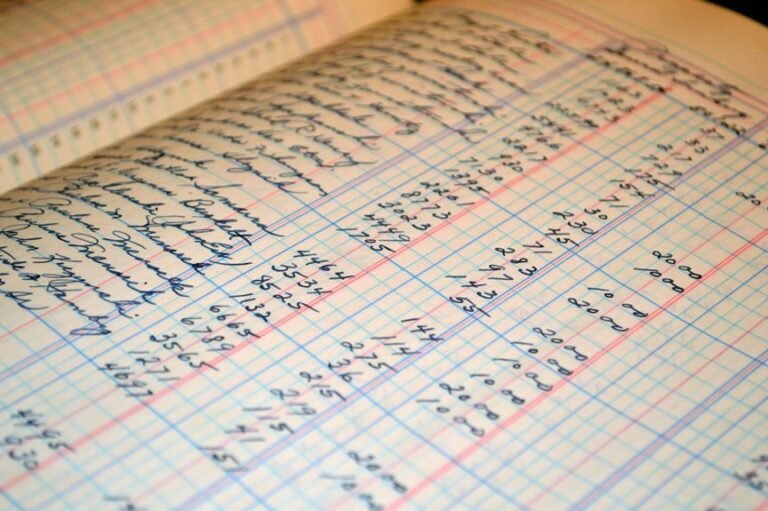

Understanding the Basics of Bookkeeping

Bookkeeping serves as the foundation of effective financial management, enabling organizations to track their financial transactions systematically.

Understanding bookkeeping terminology is crucial for interpreting financial statements accurately. Key concepts such as assets, liabilities, and equity form the backbone of this practice, ensuring clarity in financial reporting.

Mastery of these basics empowers individuals and organizations to navigate their finances with confidence and autonomy.

Key Tools and Software for Effective Financial Management

Effective financial management hinges on the selection of appropriate tools and software that streamline bookkeeping processes.

Cloud accounting platforms enhance accessibility and collaboration, allowing users to manage finances from anywhere.

Additionally, robust expense tracking software automates the monitoring of expenditures, providing valuable insights into spending patterns.

Best Practices for Maintaining Accurate Financial Records

Maintaining accurate financial records is crucial for any individual or organization seeking to achieve financial stability and transparency.

Implementing robust record organization practices ensures that documents are easily retrievable and systematically maintained. Adhering to compliance standards further enhances credibility, minimizing risks associated with audits and financial mismanagement.

Consistent reviews and updates of records solidify this foundation, promoting informed decision-making and fostering trust.

Strategies for Analyzing and Utilizing Financial Data

How can organizations transform raw financial data into actionable insights?

By employing financial ratios to assess performance and using data visualization techniques, entities can uncover trends and patterns.

Analyzing these metrics allows for informed decision-making, promoting financial health.

Ultimately, leveraging these strategies empowers organizations to not only understand their financial standing but also to navigate toward sustainable growth and independence.

Conclusion

In conclusion, mastering bookkeeping is not just a skill but a launchpad for unparalleled financial empowerment. By grasping fundamental concepts and leveraging modern tools, individuals can transform their financial journeys into a symphony of growth and sustainability. Adhering to best practices in record-keeping and data analysis enables informed decision-making, ultimately leading to financial autonomy. With diligent bookkeeping, one can navigate the complex financial landscape as if wielding a magic wand, unlocking endless possibilities for success.