Insights and Strategies for Bookkeeping 8186726442

The realm of bookkeeping requires a solid grasp of fundamental concepts for effective financial oversight. By establishing efficient systems and integrating technology, organizations can enhance accuracy and streamline their processes. Regular audits and organized documentation play essential roles in maintaining record integrity. As businesses seek to improve their financial outcomes, the exploration of advanced strategies may uncover opportunities for better decision-making and operational efficiency. What innovative approaches could redefine traditional bookkeeping practices?

Understanding the Basics of Bookkeeping

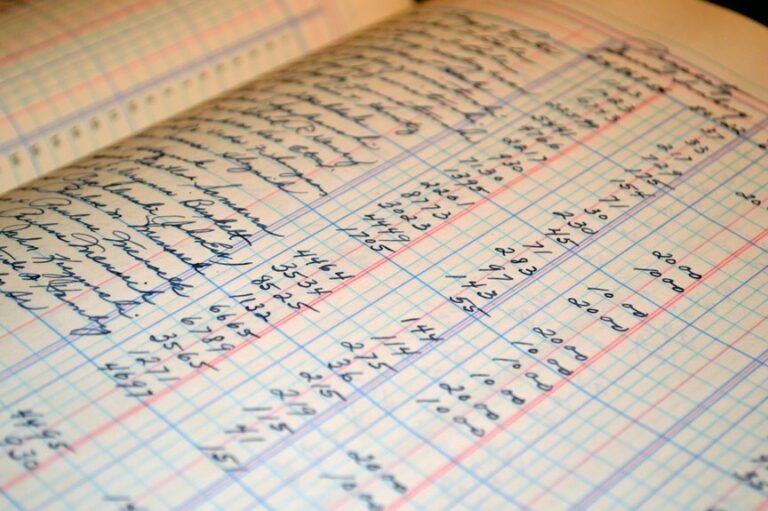

Although bookkeeping may seem straightforward, it encompasses a range of fundamental concepts that are essential for effective financial management. Understanding bookkeeping fundamentals enhances financial literacy, enabling individuals to track income and expenses accurately.

Key principles include recording transactions, maintaining ledgers, and reconciling accounts. Mastery of these concepts empowers one to make informed financial decisions, fostering autonomy and confidence in managing personal or business finances.

Implementing Efficient Bookkeeping Systems

Building on the foundational concepts of bookkeeping, implementing efficient bookkeeping systems is vital for optimizing financial management.

By streamlining processes and automating tasks, businesses can enhance accuracy and reduce time spent on repetitive activities. Such systems empower organizations to focus on strategic growth while maintaining financial clarity.

Ultimately, efficient bookkeeping systems are essential tools for achieving operational freedom and better financial outcomes.

Leveraging Technology for Better Financial Management

As businesses seek to enhance their financial management, leveraging technology emerges as a critical strategy for achieving greater efficiency and accuracy.

Cloud accounting platforms facilitate real-time data access, while automation tools streamline repetitive tasks, reducing human error.

Best Practices for Maintaining Accurate Records

With the integration of technology in financial management, the importance of maintaining accurate records becomes increasingly evident.

Best practices for achieving record accuracy include implementing systematic document organization strategies. This encompasses regular audits, utilizing digital tools for tracking, and maintaining clear labeling systems.

Conclusion

In conclusion, mastering bookkeeping fundamentals, coupled with efficient systems and technology, significantly enhances financial management. For instance, a small retail business that adopted a cloud-based accounting platform experienced a 30% reduction in errors and a 50% increase in report generation speed. This transformation not only streamlined operations but also empowered the owner to make informed decisions swiftly. By embracing these strategies, organizations can achieve greater financial clarity and drive improved outcomes, ultimately fostering a culture of confidence in their financial practices.