Mastering Bookkeeping Fundamentals 18666992794

Mastering bookkeeping fundamentals is essential for effective financial management. Understanding the basics allows individuals to maintain organized records, which enhances transparency. Key financial statements, like income statements and balance sheets, depend on accurate bookkeeping. However, many face challenges with common mistakes that can jeopardize financial health. Identifying these pitfalls and employing essential techniques can lead to better decision-making. The implications of this knowledge can shape the future of any business.

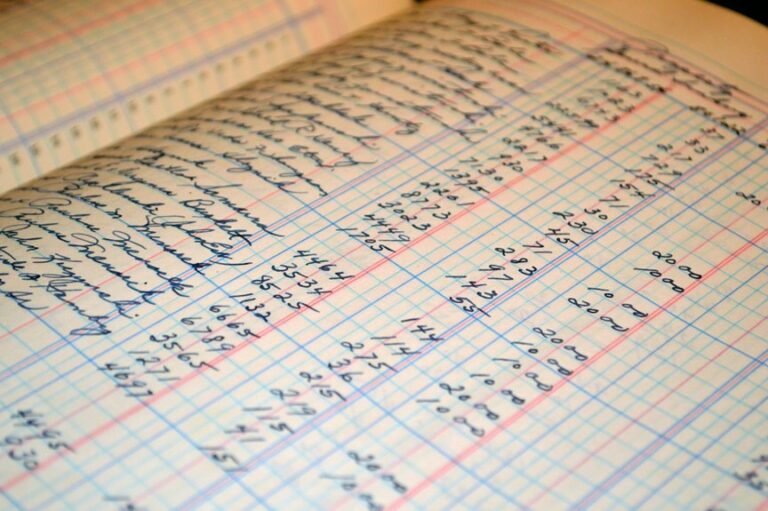

Understanding the Basics of Bookkeeping

Bookkeeping serves as the backbone of financial management, providing essential structure to the recording of economic transactions.

Understanding bookkeeping terminology is crucial for accurately categorizing financial transactions and maintaining clarity in financial records. This foundational knowledge empowers individuals to navigate their financial landscape with confidence, ensuring that every transaction is documented systematically.

Thus, promoting transparency and informed decision-making within their financial pursuits.

Key Financial Statements Explained

Accurate bookkeeping lays the groundwork for understanding key financial statements, which are vital for assessing a business’s financial health.

The income statement provides insights into revenue and expenses, revealing profitability over a specific period.

Meanwhile, the balance sheet offers a snapshot of assets, liabilities, and equity at a given time, facilitating informed decision-making and strategic planning for future growth.

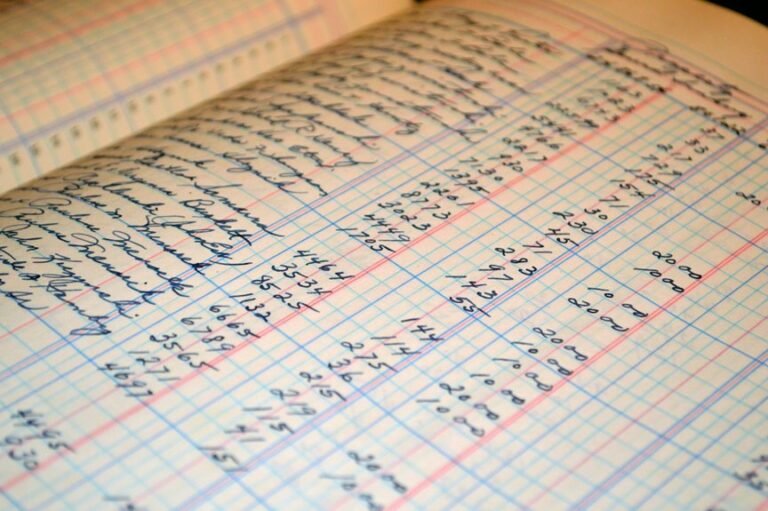

Essential Bookkeeping Techniques

Effective bookkeeping techniques are crucial for maintaining organized financial records and ensuring compliance with regulatory standards.

Essential practices include diligent record keeping, which safeguards against discrepancies, and thorough transaction analysis, enabling accurate financial assessments.

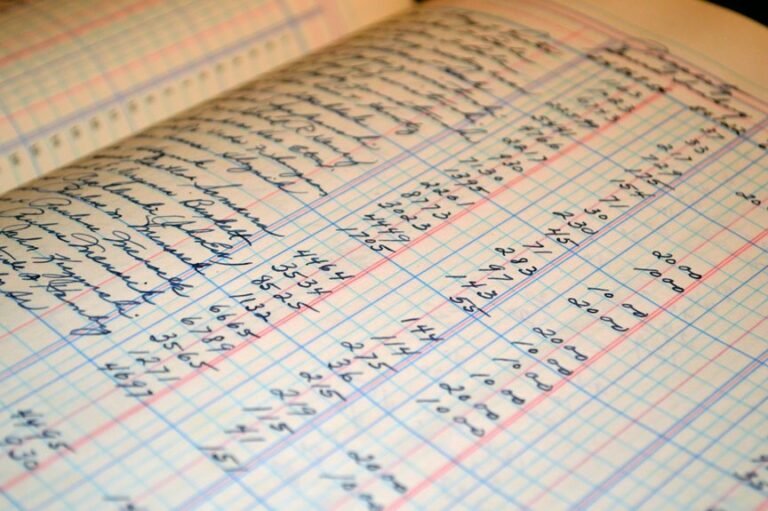

Common Bookkeeping Mistakes to Avoid

Numerous businesses encounter pitfalls in their bookkeeping practices that can lead to significant financial mismanagement.

Common mistakes include inaccurate data entry, which undermines the integrity of financial records, and ineffective expense tracking, resulting in overlooked costs.

These errors can obscure a business’s true financial health, ultimately hindering informed decision-making.

Conclusion

In conclusion, mastering bookkeeping fundamentals is essential for financial clarity and effective decision-making. According to a 2021 survey, nearly 60% of small businesses fail due to poor financial management, highlighting the critical importance of accurate bookkeeping practices. By understanding key financial statements and employing essential techniques, individuals can avoid common pitfalls and ensure their financial records are reliable. This foundational knowledge not only supports strategic growth but also safeguards a business’s long-term viability in an increasingly competitive landscape.