Mastering the Basics of Bookkeeping 6147210854

Mastering the basics of bookkeeping is a critical skill for achieving financial stability. It requires a clear understanding of financial statements, diligent tracking of expenses, and the application of double-entry bookkeeping. Effective organization of financial records plays a pivotal role in enhancing clarity. As individuals and businesses strive for informed decision-making and long-term prosperity, the implications of these foundational practices become increasingly significant. What strategies can be implemented to enhance this essential skill set?

Understanding Financial Statements

Understanding financial statements is crucial for anyone involved in bookkeeping, as these documents serve as the foundation for assessing a business’s financial health.

The income statement, a key component, provides insights into revenue and expenses, allowing for the calculation of financial ratios.

These ratios facilitate comparative analysis, enabling stakeholders to make informed decisions and pursue financial independence with clarity and confidence.

The Importance of Tracking Expenses

Although many businesses focus primarily on revenue generation, tracking expenses is equally vital for maintaining financial stability and growth.

By categorizing expenses into distinct expense categories, businesses can identify areas for potential savings.

Utilizing effective tracking methods enhances budget management and financial forecasting, empowering organizations to make informed decisions that align with their goals of operational efficiency and long-term freedom.

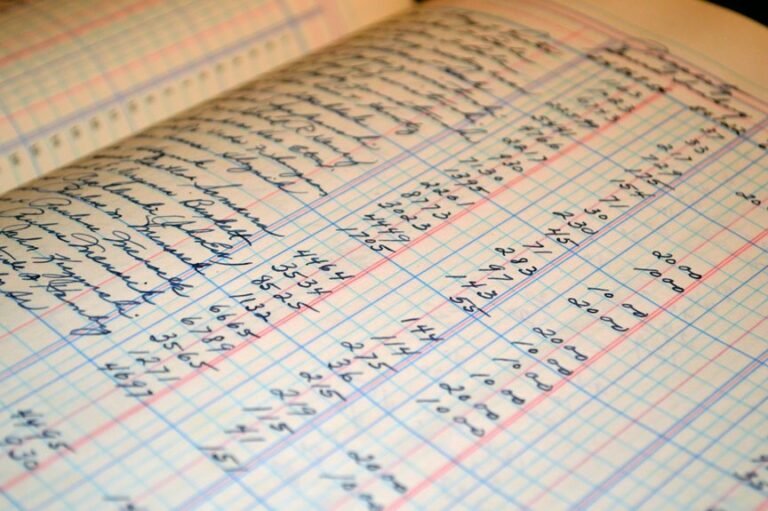

Basics of Double-Entry Bookkeeping

Double-entry bookkeeping serves as the foundational framework for accurate financial reporting, ensuring that every transaction is recorded in two accounts—debit and credit—thus maintaining the accounting equation’s balance.

Adhering to double entry principles, this system enhances accountability and transparency in financial records.

Each debit entry corresponds with a credit entry, creating a clear, organized structure that supports informed decision-making and financial freedom.

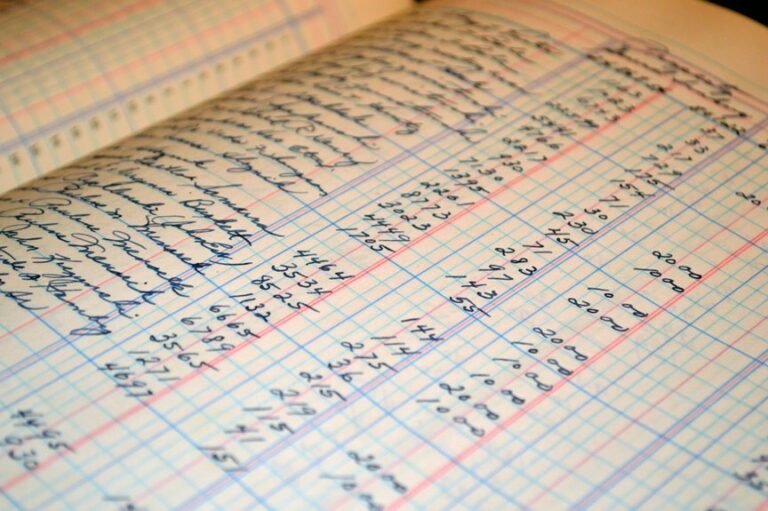

Tips for Organizing Your Financial Records

Effective organization of financial records is essential for maintaining clarity and efficiency in bookkeeping practices.

Implementing a robust digital organization system enhances record retention, facilitating easy access and retrieval.

Categorizing documents by type and date streamlines the process, while regular audits ensure compliance.

Adopting these strategies empowers individuals to manage their finances more effectively, fostering a sense of freedom and control over their financial landscape.

Conclusion

In conclusion, mastering the basics of bookkeeping is a crucial step toward financial empowerment and stability. Effective financial management not only enhances decision-making but also contributes to long-term success. Notably, studies indicate that businesses with organized bookkeeping practices are 50% more likely to experience growth than those without. By emphasizing the understanding of financial statements, diligent expense tracking, and the principles of double-entry bookkeeping, individuals can significantly improve their financial health and navigate the complexities of their financial landscape.