Maximizing Your Business Potential With Bookkeeping 6145022222

Maximizing business potential requires a strategic approach to financial management. Accurate bookkeeping is critical for understanding cash flow and identifying growth opportunities. Bookkeeping 6145022222 offers tools to streamline operations and enhance decision-making. By providing timely financial insights, businesses can effectively navigate challenges and optimize resources. The question remains: how can these practices specifically reduce tax liabilities and improve overall profitability?

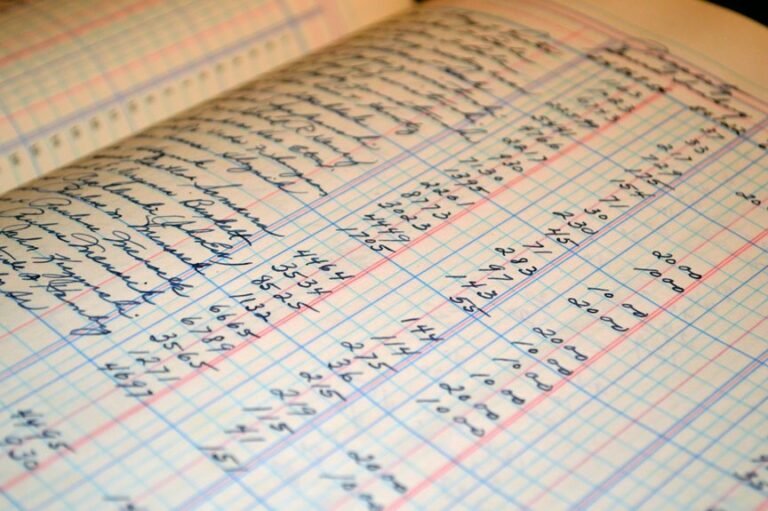

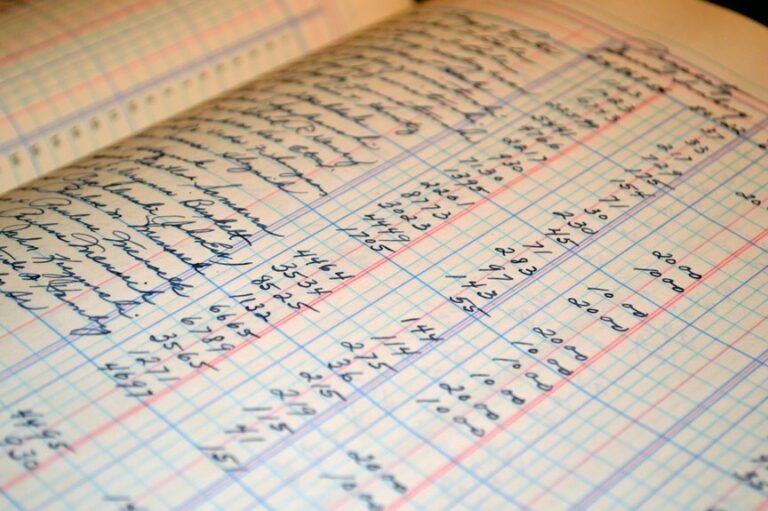

The Importance of Accurate Bookkeeping

Accurate bookkeeping serves as the backbone of any successful business, as it provides essential financial insights that guide strategic decision-making.

Financial accuracy ensures that businesses can assess profitability, manage expenses, and prepare for growth.

Effective record management allows for timely data retrieval, enabling informed choices that enhance operational efficiency.

Ultimately, precise bookkeeping fosters a sense of freedom by empowering entrepreneurs to navigate their financial landscapes confidently.

How Bookkeeping 6145022222 Can Streamline Your Operations

Implementing Bookkeeping 6145022222 can significantly enhance operational efficiency across various business functions.

By optimizing cost management, businesses can allocate resources more effectively, reducing unnecessary expenditures.

Streamlined bookkeeping processes facilitate timely financial reporting, enabling faster decision-making and improved cash flow.

Ultimately, this approach fosters a more agile organization, allowing for the freedom to pursue growth opportunities while maintaining financial stability.

Leveraging Financial Insights for Strategic Decision-Making

Harnessing financial insights enables businesses to make informed strategic decisions that drive growth and sustainability.

By employing data analysis techniques, organizations can enhance financial forecasting, identifying trends and potential market shifts.

This analytical approach empowers leaders to allocate resources effectively, optimize investments, and mitigate risks, ultimately fostering an environment conducive to innovation and flexibility.

This allows businesses to navigate challenges and seize opportunities with confidence.

Minimizing Tax Liabilities and Enhancing Profitability

Effective financial management not only informs strategic decision-making but also plays a pivotal role in minimizing tax liabilities and enhancing profitability.

Conclusion

In the intricate tapestry of business, accurate bookkeeping serves as the compass guiding entrepreneurs through turbulent waters. Bookkeeping 6145022222 embodies this compass, enabling businesses to navigate towards financial clarity and growth. By harnessing insights and streamlining operations, it transforms chaos into order, allowing for strategic decision-making that minimizes tax burdens and maximizes profitability. As each financial stitch is woven with precision, the fabric of success becomes resilient, positioning businesses to thrive in an ever-evolving marketplace.