Maximizing Profit With Bookkeeping 3309616815

Effective bookkeeping is essential for any business aiming to maximize profit. Accurate financial records provide critical insights into income and expenses. By implementing key bookkeeping practices, businesses can achieve financial clarity. Furthermore, the integration of technology can streamline these processes, enhancing efficiency. However, the true potential lies in the ability to analyze this financial data. Understanding these elements may reveal strategies that significantly impact profitability. What insights could emerge from a closer examination?

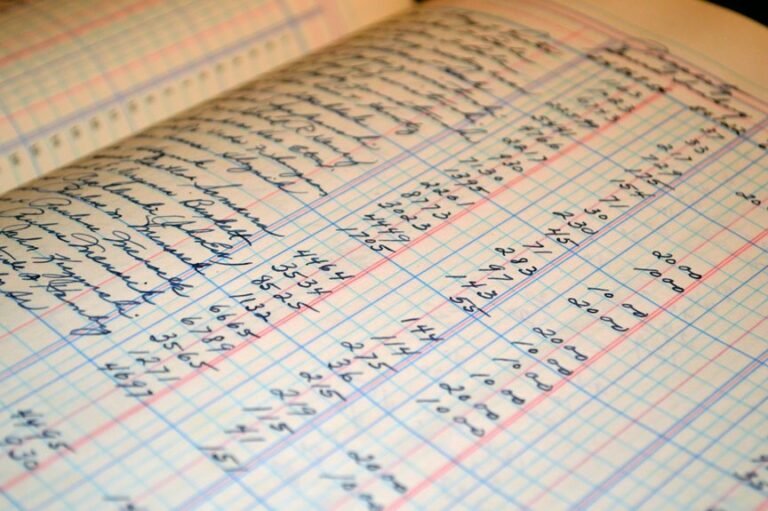

Understanding the Importance of Accurate Bookkeeping

Accurate bookkeeping serves as the backbone of a business’s financial health, as it provides essential insights into income, expenses, and overall fiscal performance.

Financial accuracy ensures that businesses maintain proper records, facilitating tax compliance and minimizing liabilities.

Key Bookkeeping Practices for Financial Clarity

Maintaining financial clarity requires the implementation of specific bookkeeping practices that systematically track and analyze monetary activities.

Effective budget tracking allows businesses to compare actual expenditures against planned allocations, ensuring resources are utilized efficiently.

Additionally, proper expense categorization helps identify spending patterns, enabling informed decision-making.

Together, these practices foster transparency, ultimately leading to enhanced financial understanding and the potential for increased profitability.

Leveraging Technology for Efficient Bookkeeping

As businesses increasingly recognize the importance of efficient bookkeeping, leveraging technology becomes essential for streamlining financial processes.

Cloud software facilitates real-time data access and collaboration, enhancing transparency. Additionally, automated invoicing minimizes manual errors and accelerates cash flow, allowing organizations to focus on growth.

Analyzing Financial Data to Drive Profitability

Analyzing financial data is crucial for businesses aiming to enhance profitability.

By evaluating financial ratios, companies can identify strengths and weaknesses in their operations.

Monitoring cash flow provides insights into liquidity and operational efficiency.

This analytical approach allows businesses to make informed decisions, optimize resource allocation, and ultimately drive profitability, ensuring long-term sustainability and financial freedom in a competitive market.

Conclusion

In conclusion, effective bookkeeping acts as the compass guiding a business through the turbulent waters of financial management. Just as a ship relies on accurate navigation to reach its destination, businesses depend on precise financial records to identify opportunities and mitigate risks. For instance, a study revealed that companies employing automated bookkeeping saw a 30% increase in profitability within a year. Thus, robust bookkeeping not only clarifies financial standing but also charts a course towards sustainable growth and success.