Navigating Complex Accounts With Bookkeeping 910626914

Navigating complex accounts presents unique challenges for businesses, necessitating a robust bookkeeping strategy. Effective account reconciliation is crucial for identifying discrepancies and ensuring data accuracy. Additionally, leveraging modern tools can enhance collaboration and efficiency, leading to informed decision-making. However, businesses must also consider the importance of financial compliance. Understanding these elements can significantly influence long-term financial health and stability. What strategies can organizations adopt to optimize their bookkeeping processes?

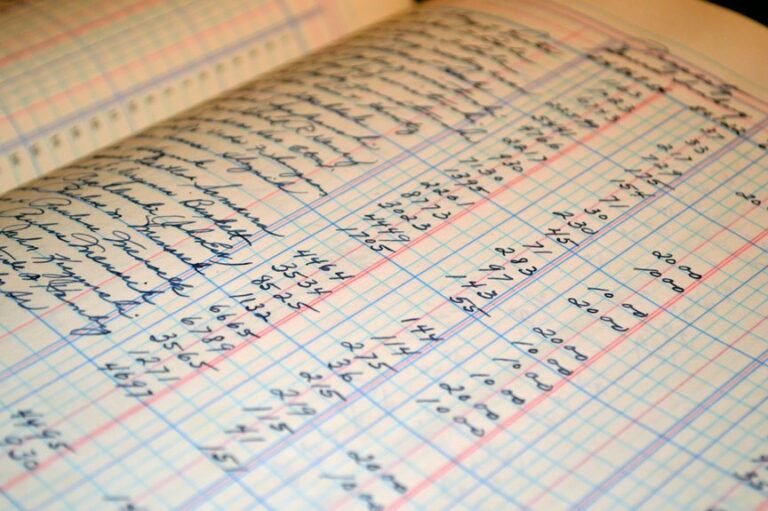

Understanding the Basics of Bookkeeping

Although bookkeeping may appear straightforward at first glance, it encompasses a range of practices that are crucial for accurate financial management.

Understanding fundamental financial terms and adhering to essential bookkeeping principles allows individuals and businesses to maintain clear records.

These practices ensure transparency, facilitate decision-making, and support financial freedom by enabling stakeholders to monitor their financial health effectively and make informed choices.

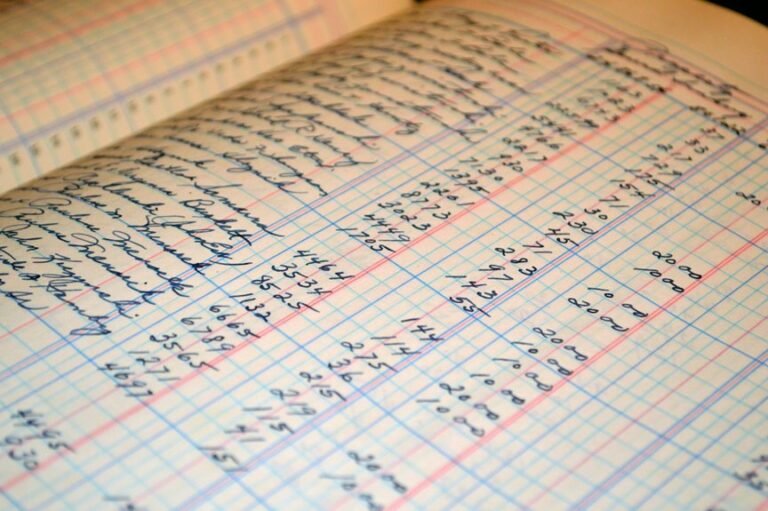

Key Strategies for Managing Complex Accounts

Effectively managing complex accounts requires a strategic approach that incorporates meticulous organization and a robust understanding of financial intricacies.

Key strategies include regular account reconciliation to identify discrepancies and ensure accuracy, alongside proactive financial forecasting to anticipate future trends.

These practices empower businesses to maintain financial stability, enhance decision-making, and navigate the complexities of their financial landscape with confidence and agility.

Tools and Software for Streamlined Bookkeeping

Managing complex accounts necessitates not only strategic oversight but also the integration of reliable tools and software that can streamline bookkeeping processes.

Cloud-based solutions offer real-time access to financial data, enhancing collaboration and efficiency.

Additionally, mobile applications facilitate on-the-go management, allowing users to monitor accounts and execute transactions seamlessly.

Together, these technologies empower businesses to achieve greater financial autonomy and clarity.

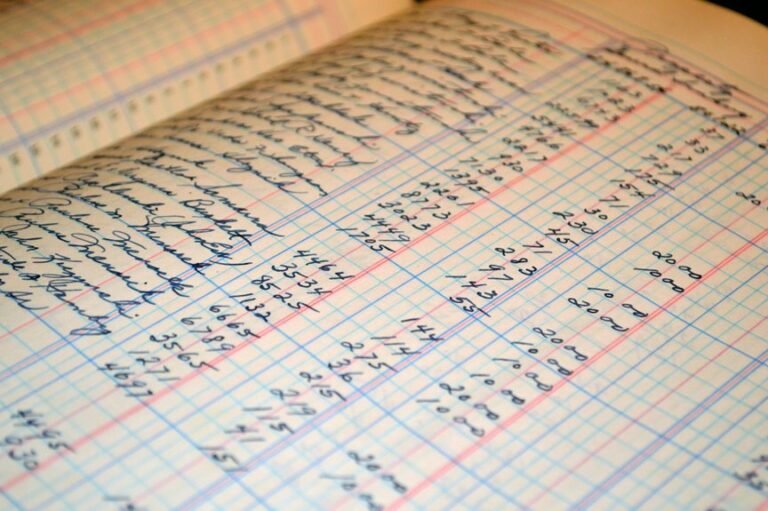

Best Practices for Maintaining Financial Compliance

How can organizations ensure adherence to financial regulations while navigating the complexities of their operations?

Implementing robust internal controls, conducting regular compliance audits, and maintaining transparent financial records are essential practices.

Additionally, staying updated on regulatory changes and providing ongoing training for staff fosters a culture of compliance, empowering organizations to manage risks effectively while promoting operational freedom and integrity.

Conclusion

In navigating the intricate world of bookkeeping, one might humorously conclude that the real complexity lies not in the accounts themselves, but in the sheer number of tools available to simplify them. While modern software promises effortless management, it often requires a level of expertise that can leave even the most organized professional feeling bewildered. Ultimately, those who master these paradoxes will find that clarity in finances is not just a goal, but a rewarding journey fraught with irony.