Navigating Financial Systems With Bookkeeping 3056308990

The course “Bookkeeping 3056308990” provides a structured approach to financial management. It highlights the fundamental principles of bookkeeping, essential for tracking income and expenses accurately. Participants learn critical financial tools, which enhance their ability to manage cash flow effectively. Furthermore, the course prepares individuals for tax season, ensuring they can organize their finances systematically. This foundation raises questions about the broader implications of effective bookkeeping on business growth and financial stability.

Understanding the Basics of Bookkeeping

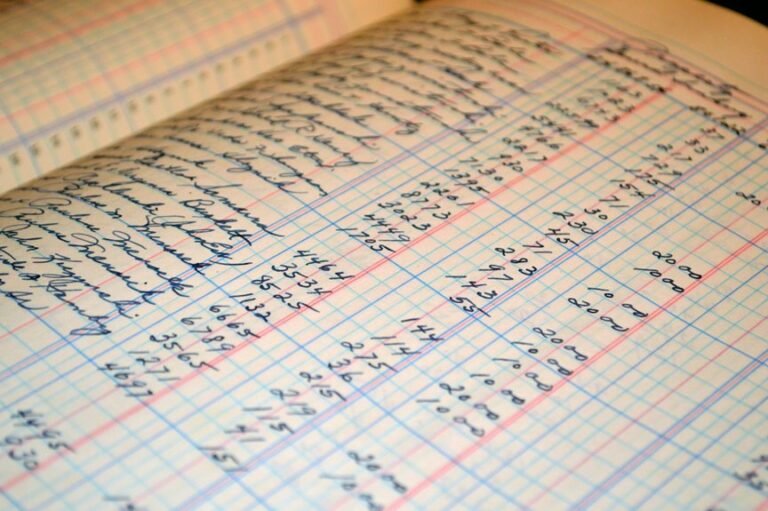

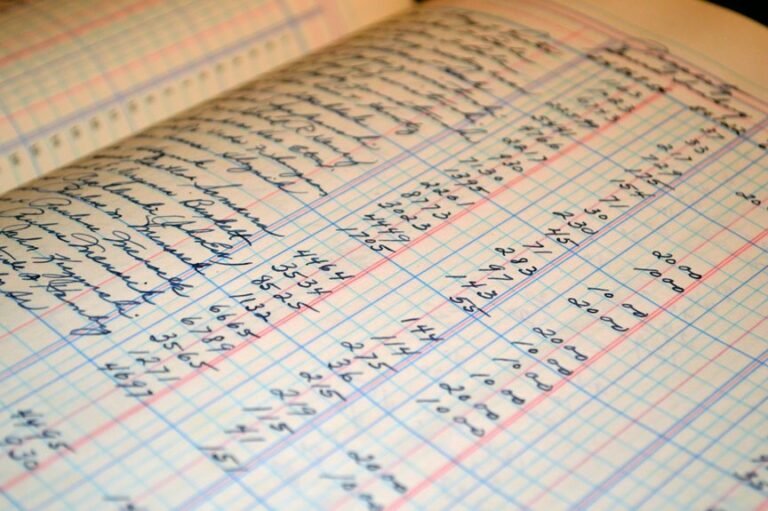

Although bookkeeping may seem straightforward, it encompasses a range of fundamental principles that serve as the backbone of effective financial management.

Mastering bookkeeping fundamentals is essential for accurate financial recordkeeping, which allows businesses to track income and expenses efficiently.

These principles facilitate informed decision-making, ensuring that entrepreneurs can maintain financial freedom while fostering growth and stability within their organizations.

Essential Financial Tools for Small Businesses

Effective bookkeeping lays the groundwork for understanding the financial landscape of a small business, but it is only one piece of the puzzle.

Essential financial tools such as financial software streamline operations and enhance accuracy, while robust expense tracking systems provide insight into spending patterns.

These tools empower small business owners to make informed decisions, fostering financial freedom and sustainable growth.

Managing Cash Flow Effectively

How can small businesses ensure they maintain a healthy cash flow amidst fluctuating revenues and expenses?

Effective cash flow forecasting and meticulous expense tracking are essential strategies. By projecting future cash inflows and outflows, businesses can anticipate shortfalls and adjust spending accordingly.

Regularly monitoring expenses enables proactive management, ensuring that resources are allocated efficiently and maintaining financial stability in uncertain environments.

Preparing for Tax Season With Confidence

What strategies can small businesses employ to prepare for tax season with confidence?

Effective financial organization is crucial, enabling businesses to track expenses and eligible tax deductions accurately.

Implementing a systematic record-keeping process ensures all financial documents are readily accessible.

Additionally, consulting with a tax professional can provide insights into maximizing deductions, ultimately promoting a sense of security and freedom during the tax preparation process.

Conclusion

In the grand tapestry of financial management, bookkeeping serves as the sturdy loom, weaving together the threads of income and expenses into a coherent fabric. Just as a skilled artisan meticulously aligns each strand to create a masterpiece, so too must business owners embrace the fundamentals taught in “Bookkeeping 3056308990.” By mastering these principles, they not only prepare for the inevitable tax season but also craft a resilient financial future, ensuring their enterprise flourishes amidst the complexities of the marketplace.