The Art of Financial Recordkeeping in Bookkeeping 6153389567

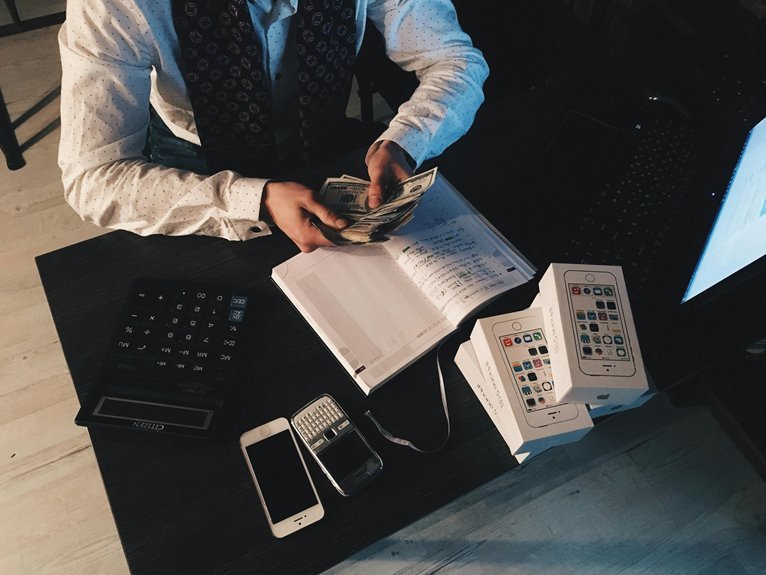

Financial recordkeeping in bookkeeping serves as the backbone of organizational transparency and compliance. It encompasses the meticulous documentation of financial transactions, which is essential for informed decision-making. Advanced tools and software have emerged to enhance accuracy and efficiency in this process. However, challenges persist, and common pitfalls can undermine effective recordkeeping. Understanding these nuances is crucial for those looking to master this essential skill. What strategies can be employed to optimize this vital function?

Understanding the Fundamentals of Financial Recordkeeping

Financial recordkeeping serves as the backbone of effective bookkeeping, ensuring that an organization’s financial transactions are accurately documented and systematically organized.

Proper understanding of financial statements and stringent record retention policies are essential for maintaining compliance and facilitating informed decision-making.

This foundational knowledge empowers organizations to manage their resources effectively, fostering a culture of transparency and accountability that supports long-term financial freedom.

Essential Tools and Software for Effective Bookkeeping

Effective bookkeeping hinges on the utilization of appropriate tools and software that streamline financial processes and enhance accuracy.

Cloud-based solutions offer flexibility and accessibility, allowing users to manage records remotely. Automated tracking features minimize human error and save time, ensuring that financial data remains up-to-date.

Common Mistakes to Avoid in Financial Recordkeeping

Avoiding common pitfalls in financial recordkeeping is crucial for maintaining accurate and reliable records.

Recording errors and documentation oversight can lead to significant discrepancies, undermining the integrity of financial data.

To ensure effective recordkeeping, individuals must remain vigilant, regularly auditing their entries and confirming that all documentation is complete.

Strategies for Streamlining Your Bookkeeping Process

Streamlining the bookkeeping process requires a strategic approach that incorporates automation, organization, and consistent practices.

Implementing automation techniques can reduce manual tasks, enhancing efficiency and accuracy. Additionally, establishing robust documentation practices ensures that financial records are organized and easily accessible.

Conclusion

In conclusion, the art of financial recordkeeping is indispensable for any organization seeking longevity and accountability. An interesting statistic reveals that businesses with effective bookkeeping practices are 50% more likely to achieve long-term financial stability. By embracing advanced tools and avoiding common pitfalls, companies can enhance their financial transparency and decision-making capabilities. Ultimately, mastering this essential skill not only promotes compliance but also paves the way for sustainable growth and resource management.