Understanding Financial Records in Bookkeeping 5025130632

Understanding financial records in bookkeeping, particularly through code 5025130632, reveals critical aspects of effective financial management. This code facilitates the organization and monitoring of transactions, which are vital for accuracy in reporting. Accurate records are not just numbers; they include comprehensive logs and documentation that enhance transparency. The implications of these practices extend beyond mere compliance, influencing stakeholder trust and decision-making processes. Further exploration of these facets uncovers deeper financial insights.

Overview of Bookkeeping Code 5025130632

The bookkeeping code 5025130632 serves as a critical identifier within financial record-keeping systems, facilitating the classification and tracking of specific financial transactions.

Understanding this code is essential for mastering bookkeeping basics and utilizing appropriate financial terminology. It enhances clarity in records, ensuring accurate reporting and analysis, ultimately promoting informed decision-making for individuals seeking autonomy in their financial management.

Key Components of Financial Records

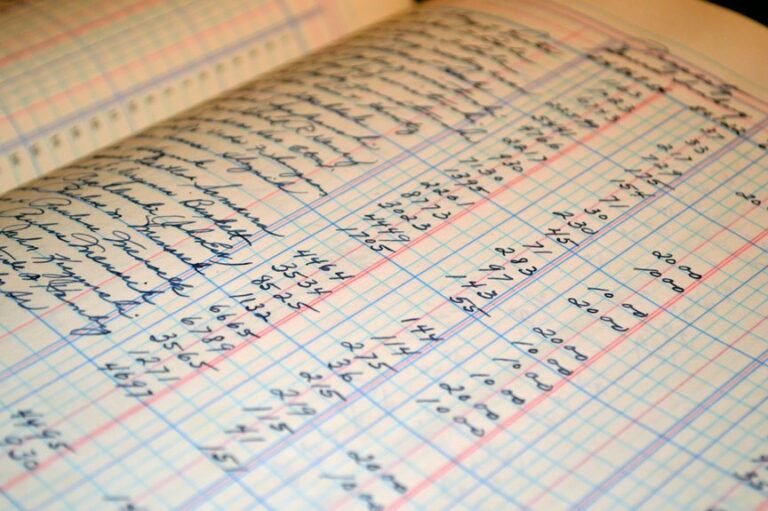

Essential elements of financial records include transactions, accounts, and supporting documentation, all of which play a vital role in effective bookkeeping.

Financial statements summarize financial performance, while transaction logs provide detailed records of individual monetary movements.

Together, these components ensure transparency and accuracy, empowering stakeholders to make informed decisions.

A meticulous approach to these records fosters autonomy in financial management and reporting.

Importance of Accurate Record Keeping

Accurate record keeping serves as the backbone of effective financial management. It fosters financial accountability by ensuring that all transactions are documented and traceable.

Proper record organization enhances decision-making and compliance with regulations, ultimately safeguarding an entity’s financial health. By prioritizing accuracy in record keeping, businesses empower themselves to navigate complexities with confidence, thereby promoting transparency and fostering trust among stakeholders.

Strategies for Effective Financial Management

While many organizations recognize the significance of financial management, implementing effective strategies remains crucial for achieving long-term stability and growth.

Employing robust budgeting techniques enhances forecasting accuracy, allowing for better allocation of resources.

Additionally, monitoring cash flow is essential to ensure liquidity, preventing potential financial pitfalls.

Conclusion

In conclusion, mastering bookkeeping code 5025130632 is pivotal for effective financial management. Accurate financial records, such as transaction logs and supporting documents, foster transparency and trust among stakeholders. For instance, consider a mid-sized retail company that adopted this code to streamline its bookkeeping process. As a result, they improved their reporting accuracy, enabling timely decisions that led to a 15% increase in profitability within a year, showcasing the practical benefits of diligent financial record keeping.