Unlocking Financial Accuracy With Bookkeeping 4125470711

Accurate bookkeeping is crucial for any business striving for growth and stability. Bookkeeping 4125470711 offers specialized services that address the unique financial needs of organizations. Their approach ensures meticulous tax preparation and maximizes deductions, which minimizes the risk of errors. Understanding the significance of tailored bookkeeping solutions can enhance financial clarity and support strategic decision-making. What specific practices contribute to this accuracy, and how can they impact long-term success?

The Importance of Accurate Bookkeeping

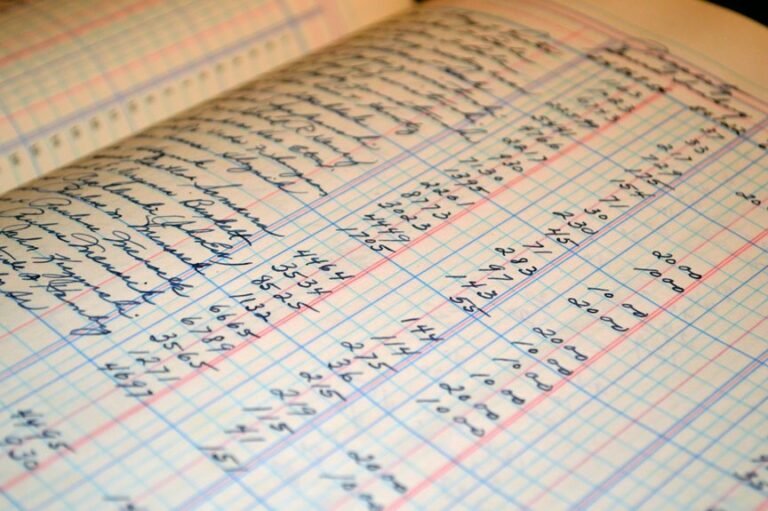

Accurate bookkeeping is essential for businesses of all sizes, as it serves as the foundation for sound financial management.

Effective record keeping ensures that financial data is organized and up-to-date, contributing directly to financial stability.

Key Bookkeeping Practices for Financial Clarity

How can businesses ensure financial clarity amidst the complexities of their operations?

Implementing effective budget tracking and precise expense categorization are essential practices. By diligently monitoring budgets, businesses can anticipate financial trends and allocate resources efficiently.

Meanwhile, categorizing expenses enables clearer visibility into spending patterns, fostering informed decision-making. Together, these practices enhance financial transparency and empower organizations to navigate their fiscal landscapes with confidence.

How Bookkeeping 4125470711 Tailors Solutions for Your Business

Bookkeeping 4125470711 recognizes the unique challenges businesses face in maintaining financial accuracy and clarity.

By offering customized solutions, the firm effectively addresses these challenges, ensuring that financial practices align with specific business needs.

This tailored approach enhances business scalability, allowing companies to adapt and grow without compromising their financial integrity.

Such precision fosters an environment conducive to informed decision-making and sustainable growth.

The Benefits of Professional Bookkeeping Services

While many business owners attempt to manage their own financial records, the advantages of professional bookkeeping services often outweigh the initial costs.

These services ensure accurate tax preparation, minimizing errors and maximizing deductions.

Furthermore, expert bookkeepers provide insights into cash flow management, allowing businesses to make informed decisions.

Ultimately, outsourcing bookkeeping enhances financial accuracy, freeing owners to focus on growth and strategic objectives.

Conclusion

In conclusion, accurate bookkeeping is not merely a financial necessity but a cornerstone of business success. Research indicates that 70% of small businesses fail due to poor financial management, underscoring the critical need for tailored bookkeeping solutions. Bookkeeping 4125470711 addresses this challenge by enhancing financial clarity and stability. By leveraging professional services, businesses can not only maximize deductions but also foster informed decision-making, paving the way for sustainable growth and long-term success in an increasingly competitive environment.