Your Path to Financial Clarity With Bookkeeping 3017668708

Financial clarity is essential for both personal and business success. The course “Bookkeeping 3017668708” provides a structured approach to mastering the fundamentals of bookkeeping. It covers essential tools and strategies that enhance financial management. By focusing on accurate record-keeping and financial analysis, individuals can make informed decisions. However, the real impact of these skills on one’s financial future warrants further exploration. What specific strategies can lead to sustained growth and accountability?

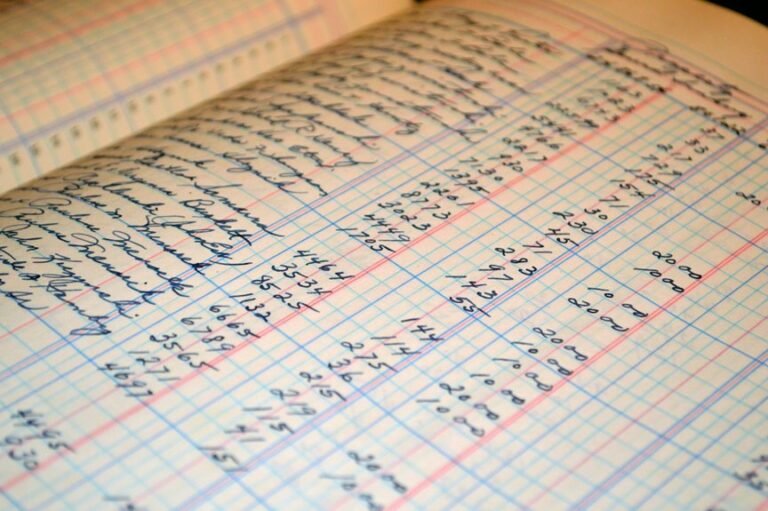

Understanding the Fundamentals of Bookkeeping

Bookkeeping serves as the backbone of financial management, providing essential insights into an organization’s economic health.

Understanding the bookkeeping basics involves grasping financial terminology, such as assets, liabilities, and equity.

Accurate record-keeping enables organizations to monitor cash flow, prepare financial statements, and ensure compliance with regulations.

This foundational knowledge empowers individuals and businesses, fostering financial independence and informed decision-making in their economic pursuits.

Essential Tools for Effective Financial Management

Effective financial management relies on a variety of essential tools that streamline processes and enhance decision-making capabilities.

Budgeting software provides users with the framework to allocate resources efficiently, while expense tracking systems ensure that spending aligns with financial goals.

Together, these tools empower individuals and organizations to maintain control over their finances, promoting transparency and fostering the freedom to make informed financial choices.

Strategies for Streamlining Your Bookkeeping Process

Streamlining the bookkeeping process is essential for enhancing overall financial efficiency.

Implementing automation techniques can significantly reduce manual tasks, allowing professionals to focus on strategic decision-making.

Additionally, effective time management practices, such as setting specific schedules for bookkeeping activities, can further optimize operations.

Analyzing Your Financial Health for Better Decision Making

A comprehensive understanding of financial health is fundamental for informed decision-making in any organization.

By analyzing cash flow and key financial ratios, businesses can assess their liquidity, profitability, and overall performance. This analytical approach enables leaders to identify strengths and weaknesses, facilitating strategic adjustments.

Ultimately, a clear financial picture empowers organizations to pursue opportunities and mitigate risks, fostering long-term freedom and growth.

Conclusion

In conclusion, mastering bookkeeping through the course “Bookkeeping 3017668708” equips individuals with vital skills for navigating the financial landscape. By understanding foundational concepts, utilizing essential tools, and streamlining processes, learners can gain a clearer picture of their financial health. This proactive approach not only enhances decision-making but also fosters a sense of accountability. Ultimately, embracing these practices allows one to take the bull by the horns, paving the way for a more confident and prosperous financial future.