The Future of Bookkeeping 4407710452

The future of bookkeeping is increasingly defined by technological advancements. Automation streamlines routine processes, while cloud technology enhances accessibility and collaboration. Artificial intelligence offers predictive capabilities, allowing for more informed decision-making. As businesses adapt to these changes, the implications for financial management are significant. Organizations must consider how these innovations will reshape their operations and competitive landscape, raising important questions about the evolving role of bookkeepers in this new environment.

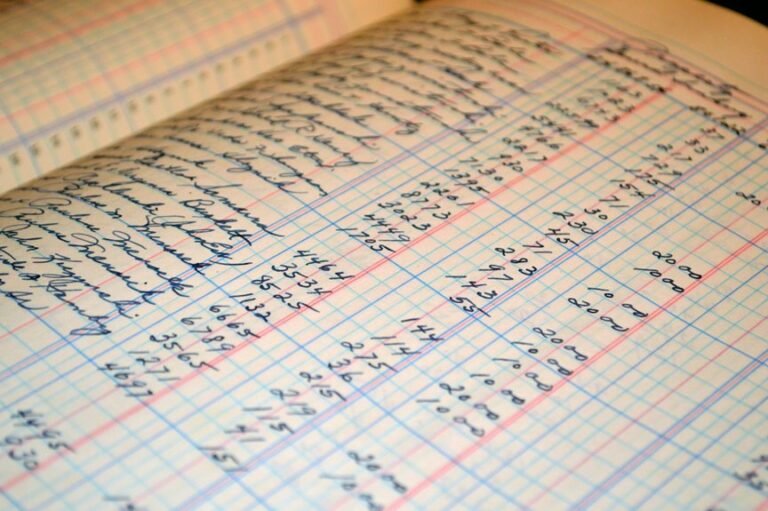

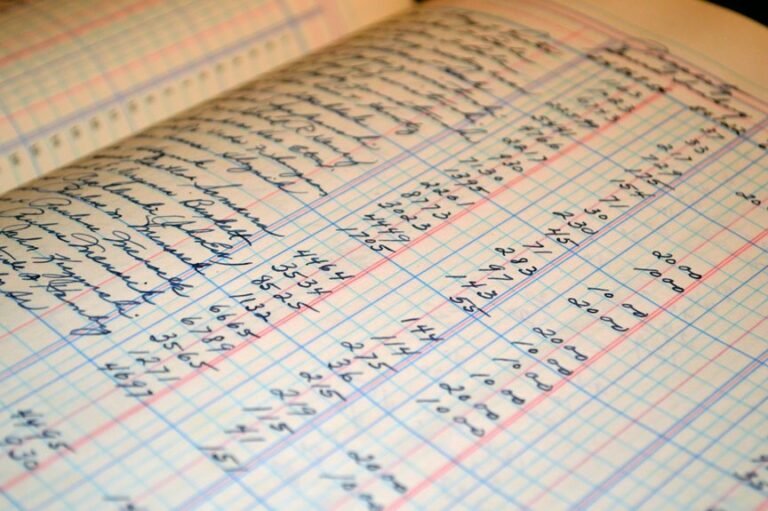

The Rise of Automation in Bookkeeping

The evolution of bookkeeping is increasingly characterized by the integration of automation, a phenomenon that reflects the industry’s adaptive response to technological advancements.

Automated invoicing systems streamline billing processes, reducing human error and enhancing efficiency.

Simultaneously, digital reconciliation tools facilitate quicker financial reviews, promoting transparency.

As these innovations proliferate, they empower businesses to focus on strategic growth while ensuring accuracy in financial management.

Embracing Cloud Technology for Financial Management

While many businesses continue to rely on traditional bookkeeping methods, a growing number are recognizing the transformative potential of cloud technology in financial management.

This shift facilitates enhanced remote collaboration, allowing teams to access real-time data from anywhere.

Moreover, robust cloud security measures ensure that sensitive financial information remains protected, empowering organizations to embrace innovation while maintaining the integrity of their financial operations.

The Role of Artificial Intelligence in Bookkeeping

Artificial intelligence (AI) is transforming bookkeeping by automating routine tasks and enhancing analytical capabilities.

By leveraging AI efficiencies, businesses can significantly reduce time spent on data entry and reconciliation.

Furthermore, predictive analytics empowers accountants to forecast financial trends, enabling proactive decision-making.

This integration not only streamlines operations but also allows professionals to focus on strategic initiatives, fostering greater organizational agility.

Real-Time Reporting and Data Analytics for Better Decision-Making

Real-time reporting and data analytics are revolutionizing decision-making processes within organizations, enabling leaders to access up-to-date financial information at their fingertips.

Conclusion

As the landscape of bookkeeping evolves, the confluence of automation, cloud technology, and artificial intelligence paints a vivid picture of a more efficient future. This digital mosaic not only reduces the potential for human error but also illuminates pathways for strategic decision-making through real-time data analytics. In this intricate dance of innovation, organizations are poised to navigate the complexities of finance with agility and foresight, transforming traditional practices into a symphony of precision and insight.